TaxJar – Sales Tax Automation for WooCommerce Plugin

Trusted by more than 20,000 businesses, TaxJar’s award-winning solution makes it easy to automate sales tax reporting and filing, and determine econom …

Painless sales tax calculations, reporting and filing for WooCommerce!

Get accurate sales tax calculations and return-ready reports. TaxJar for WooCommerce takes care of all your sales tax needs. Connect TaxJar directly with your WooCommerce store and marketplaces, to get up and running, fast.

Why WooCommerce Customers Love TaxJar:

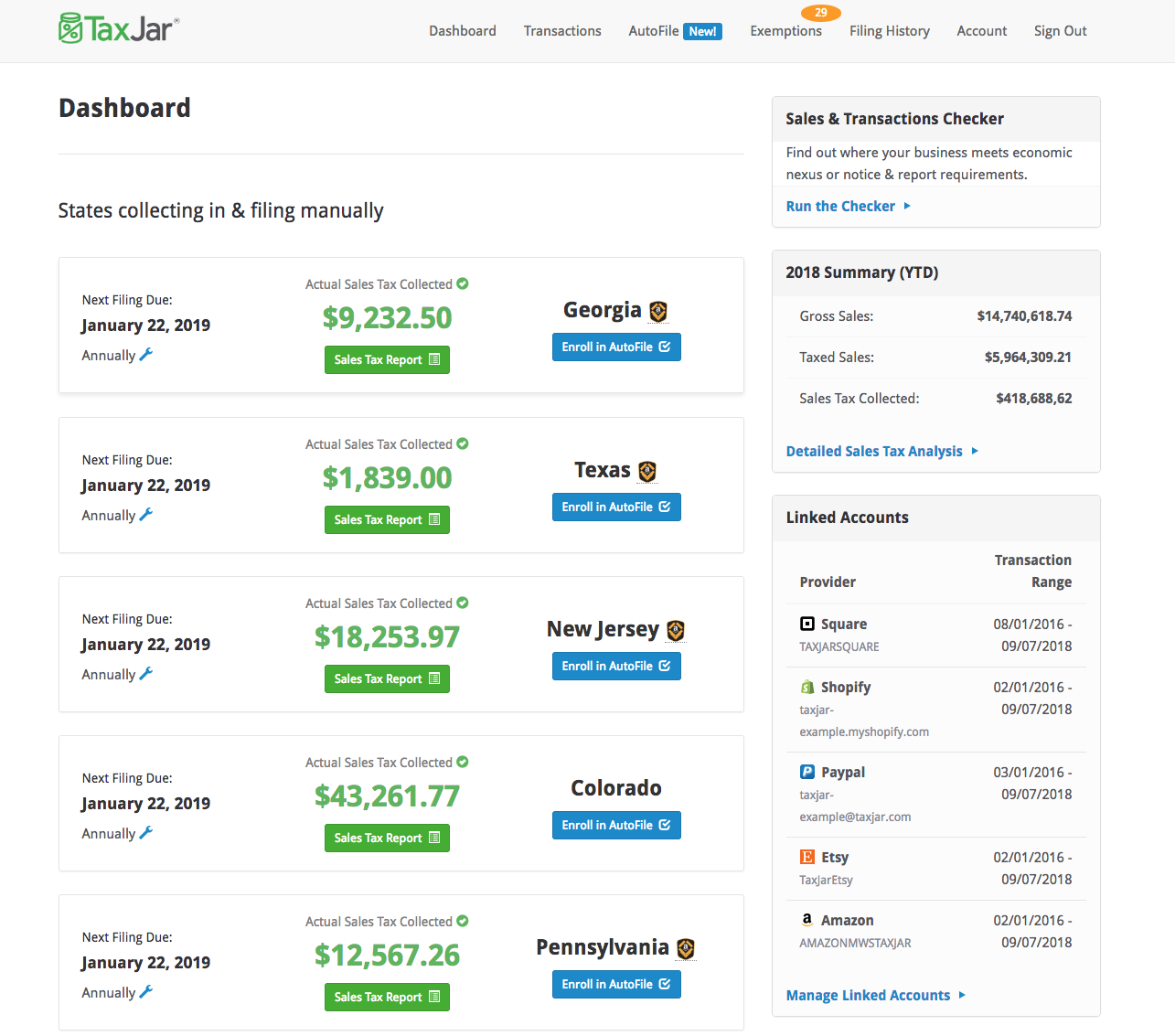

- Seamless & Automatic Filing. TaxJar AutoFile automatically submits your returns to the states where you’re registered and ensures you never miss a due date.

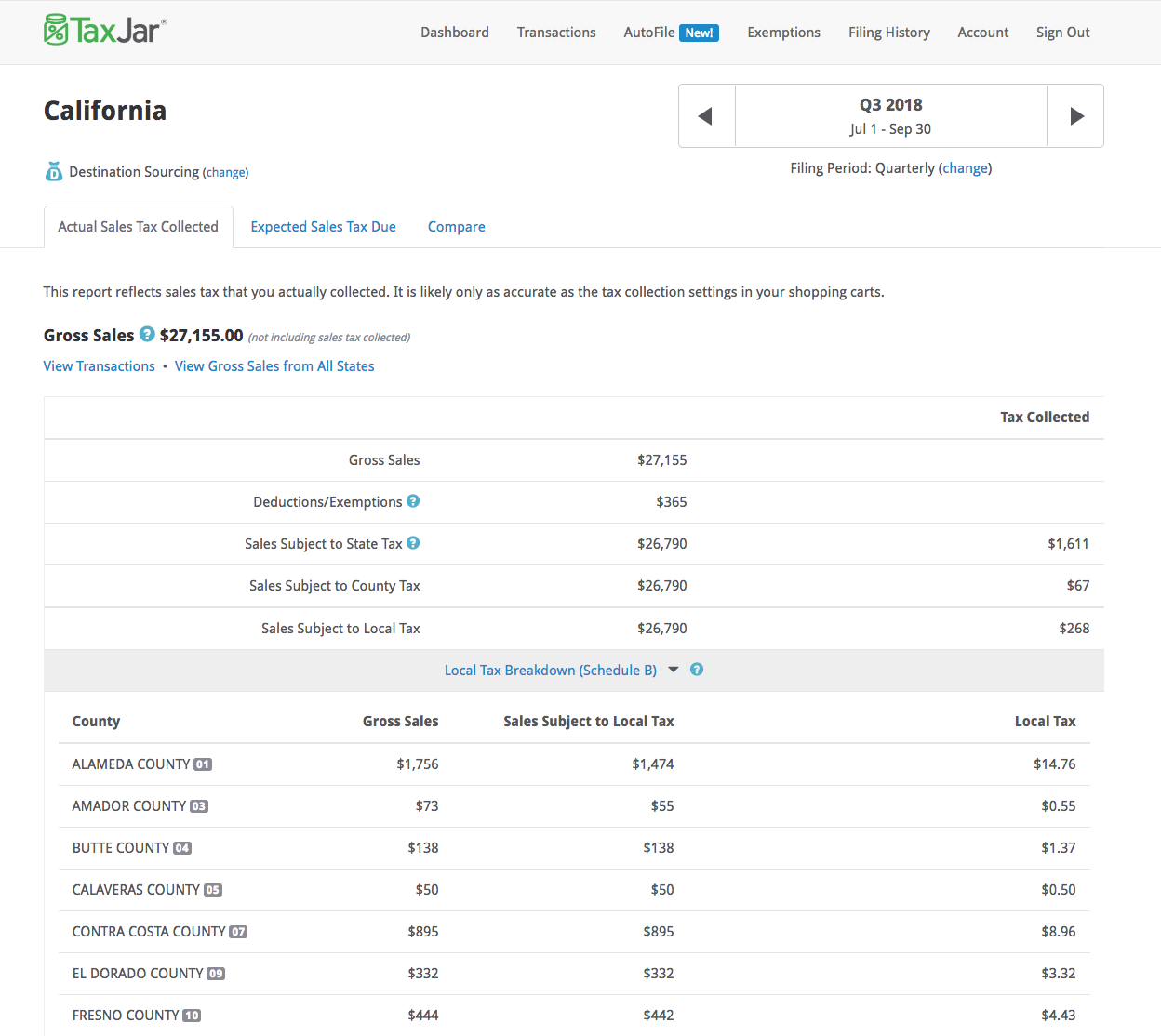

- Return-Ready, Jurisdiction-Level Reporting. TaxJar saves hours on sales tax filings by organizing sales data into easy-to-read, exportable, return-ready state reports.

- Real-time Sales Tax Rates & Calculations. TaxJar API instantly provides accurate sales tax rates at checkout for upgraded plans. With 99.99% uptime, you can count on us for your calculations. TaxJar will also have no impact on your site performance or page load times.

- Economic Nexus Insights. Import your sales data into TaxJar to determine where your sales have met or exceeded the economic threshold in each state. Get guidance on how to begin complying with sales tax in any new state.

Pricing:

- Transparent, order-based pricing.

- No setup fees, connector fees, or service filing fees.

- Contact TaxJar sales to get a free demo or a quote at 855-800-6681, or request a free demo.

- Note: If your business exceeds 1,000 orders per month, an upgraded account will be required for real-time sales tax calculations through the TaxJar API.

Other Notable Features:

- Simple onboarding accelerates the time it takes to get up and running (typically within 7 days)

- Award-Winning support. Our TaxJar experts are here to help troubleshoot and answer questions with industry-leading support.

- Exempt non-taxable products and take advantage of TaxJar’s built-in sales tax categories for product exemptions such as clothing, food, software, and more.

- If you sell on other marketplaces or platforms beyond WooCommerce, get your sales tax data all in one spot.

How It Works

Here’s how the TaxJar for WooCommerce plugin works:

At the cart and checkout page, TaxJar takes the following input from your store:

- Your store address

- Your customer’s address

- Order details such as line items and shipping

And returns accurate sales tax (including state, county, city, and special taxes) based on…

- Your store address

- Any nexus locations stored in your TaxJar account

- Local sales tax sourcing laws (origin-based or destination-based)

- Shipping taxability laws (shipping is not taxable in every state)

- Product exemptions if configured for specific products

- Itemized discounts for coupons

- Sales tax holidays

Installation

Setting up sales tax with TaxJar is simple. Read the documentation to learn more!

Or you can follow these steps to install the TaxJar plugin:

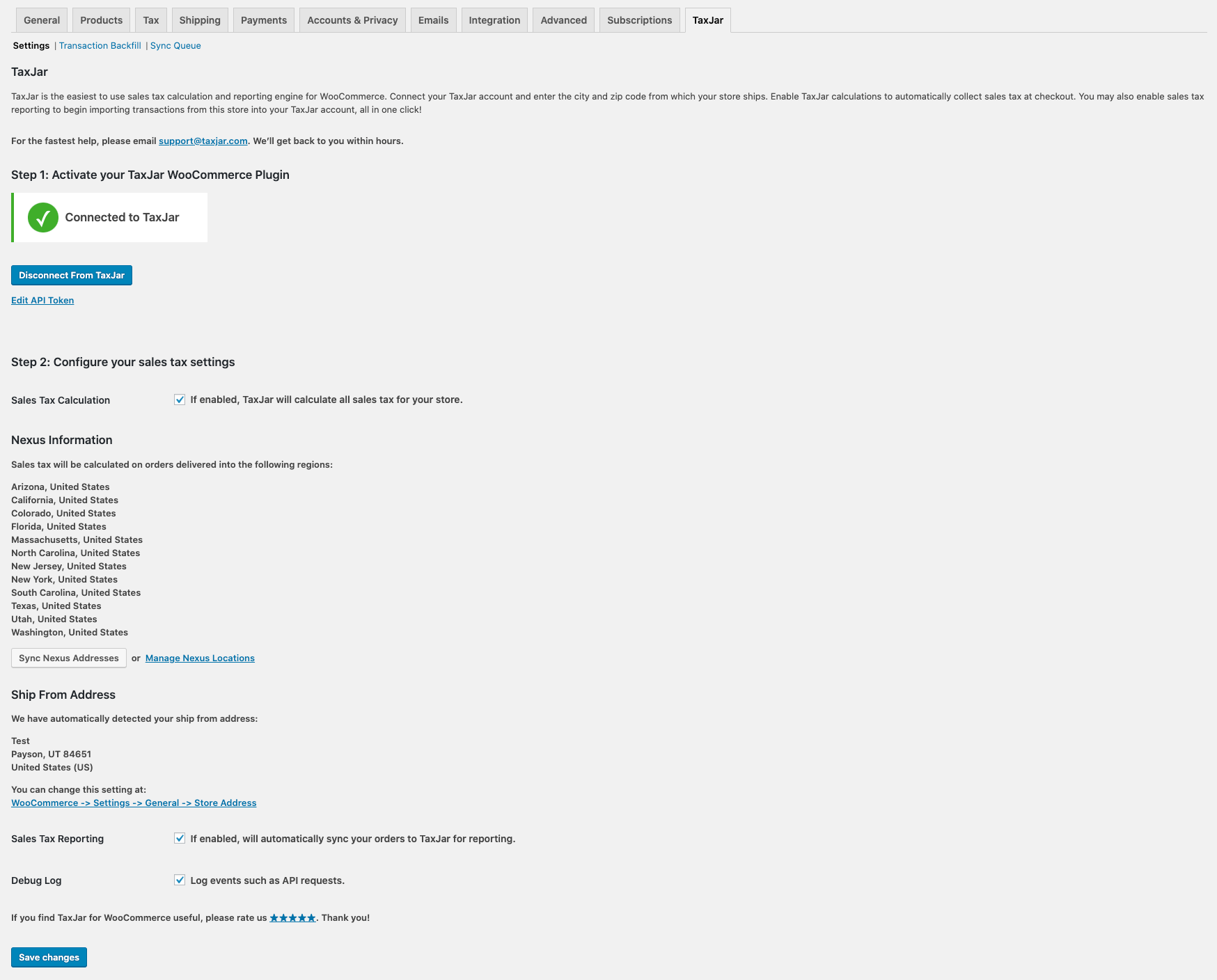

- Install the plugin in your WordPress admin panel under Plugins > Add New (search for “TaxJar”) or download the zip and upload to

/wp-content/pluginson your server. - Activate the plugin under Plugins > Installed Plugins.

- Find the TaxJar configuration under WooCommerce > TaxJar.

- Click the “Connect To TaxJar” button.

- Sign in with your TaxJar account (or create a new one) in the popup.

- Click the “Connect” button. The popup will automatically close and your WooCommerce store will be linked to your TaxJar account. Note: If your business exceeds 1,000 orders per month, you will be prompted to upgrade your account to TaxJar Professional in order to activate real-time sales tax calculations through the TaxJar API.

- Fill out the rest of your settings. TaxJar requires your city and zip code from which you ship products to calculate sales tax. We automatically detect your country and state based on your WooCommerce configuration.

- If you have multiple nexus states where you need to collect sales tax, make sure they’re added to your TaxJar account. Click the “Sync Nexus Addresses” button to import your nexus addresses into WooCommerce.

- Check the box next to “Enable TaxJar Calculations”.

- If you plan to use TaxJar for sales tax reporting and filing, check the box next to “Enable order downloads to TaxJar” for TaxJar to connect and download the transactions on your store for AutoFile and reporting features.

- Click “Save changes”. You’re now up and running with TaxJar!

Suggested WooCommerce Tax Settings

- We automatically set up your store’s tax settings to work with our API. There is no need to configure WooCommerce taxes.

- Full reporting of your sales tax collected, AutoFile and more available in your TaxJar account.

Screenshots

FAQ

As long as you have a business address, TaxJar’s plugin can calculate sales tax based on your location and the location of your customer. If your business exceeds 1,000 orders per month, a TaxJar Professional account will be required for real-time sales tax calculations through the TaxJar API. Contact TaxJar sales to get a free demo or a quote at 855-800-6681, or request a free demo.

If you don’t have a TaxJar Professional account, and have more than 1,000 orders per month, you’ll need to sign up for a TaxJar Professional plan to get calculations through the TaxJar API. Contact TaxJar sales to get a free demo or a quote at 855-800-6681, or request a free demo.

Our pricing is based on the number of WooCommerce orders you import into TaxJar. Pricing starts at $99 per month with TaxJar Professional.

Nope. The cost is the same no matter if you have nexus in one state or 40 states.

Yes. We can file sales tax returns for you in any US state.

Our plans come with filings included, with additional filings available for purchase. Learn more about our plans.

Changelog

= 4.2.1 (2023-10-04)

* WooCommerce tested up to 8.1.0

* WordPress 6.3.1 tested

= 4.2.0 (2023-09-27)

* WooCommerce tested up to 7.8.0

* Updates needed for HPOS compliance

* Flag as HPOS-enabled

= 4.1.5 (2022-10-11)

* WooCommerce tested up to 7.0.0

* Update minimum WooCommerce version to 6.4

= 4.1.4 (2022-08-19)

* WooCommerce tested up to 6.8.1

* Update minimum WooCommerce version to 6.2

= 4.1.3 (2022-06-28)

* Fix conflict with WooCommerce PDF Product Voucher plugin

* Support local pickup shipping method during calculation on admin and API orders

* Add Washington D.C. as exemption region

* Correctly calculate tax on subscription products with updated PTCs

* WooCommerce tested up to 6.6

* Update minimum WooCommerce version to 6.0

= 4.1.2 (2022-03-30)

* Fix for precision issue when syncing some orders to TaxJar

* Fix for persisting inaccurate rates in rates table

* WooCommerce tested up to 6.3

* Update minimum WooCommerce version to 5.8

= 4.1.1 (2022-02-15)

* Fix for issue where incorrect tax was applied on shipping when multiple shipping packages were selected

* Fix to add compatibility for WooCommerce Gift Card plugin

* Added feature to sync customer to TaxJar when created/updated through WooCommerce REST API

* Add feature to add customers to sync queue when created/updated through the Customer/Order/Coupon CSV Import Suite

* Add action after calculating cart totals

* WooCommerce tested up to 6.2

* Update minimum WooCommerce version to 5.7

= 4.1.0 (2022-01-19)

* Add order meta box to give details of calculation and sync statuses

* Remove usage of deprecated function is_ajax

* WooCommerce tested up to 6.1

* Update minimum WordPress version to 5.6

= 4.0.2 (2021-12-20)

* Filter invalid PTCs before creating transactions in TaxJar.

* Fix floating point precision issue causing transactions to be rejected by the TaxJar API.

= 4.0.1 (2021-11-19)

* Change dynamic tax rate ID to 999999999 to help prevent issues with 3rd parties ingesting exported WooCommerce order data

* Fix issue where shipping was still utilizing dynamic tax rate when the save rates setting was enabled.

= 4.0.0 (2021-11-11)

* Refactor cart tax calculation to stop calculation events from triggering twice

* Fix issue with tax calculation on dynamically created products and variations

* Fix issue where in some cases fees did not use correct product tax codes during calculation

* Fix issue where multiple products with the same product tax and exemption thresholds may cause incorrect tax

* Update minimum WooCommerce version to 5.4

* WooCommerce tested up to version 5.9

= 3.3.0 (2021-09-02)

* Fix php warning when store settings are not set

* Update minimum WordPress version to 5.4

* Update minimum WooCommerce version to 5.1

* WooCommerce tested up to version 5.6

* Update minimum PHP version to 7.0

= 3.2.11 (2021-07-23)

* Fix fatal error when no line items present on tax response.

= 3.2.10 (2021-06-17)

* Minor transaction sync performance improvement.

= 3.2.9 (2021-06-07)

* Add support for tax calculation in WooCommerce cart and checkout blocks.

= 3.2.8 (2021-05-27)

* Fix tax calculation issues on fee only orders when created in admin dashboard or through Woo REST API.

* Fix tax calculation on orders with only shipping in admin dashboard or when created through Woo REST API.

* Fix incorrect tax rate application on orders with multiple line items using the same product tax code when different rates should be applied to each item.

* Fix issue where during order tax calculation, incorrect shipping tax may have been applied.

* Support tax classes on fees for order tax calculation.

* Fix issues with tax calculation of subscription orders created through the Woo REST API.

* Fix VAT exemption not applying on orders created through the admin dashboard or through the Woo REST API.

* Fix fallback to billing address if shipping address not present on an order in the admin dashboard.

* Fix issue where customer exemptions weren’t being applied to a subscription order in the admin dashboard.

* Fix issue where changing a customer on an order in the admin dashboard may not have applied the exemption of the newly selected customer.

* Improve logging for order tax calculation.

* Add unit and integration tests to cover order tax calculation.

* WooCommerce 5.3.0 support

= 3.2.7 (2021-04-29)

* WooCommerce 5.2.2 Support

* Remove Action Scheduler Library

= 3.2.6 (2021-03-23)

* WooCommerce 5.1.0 Support

* Fix double subscription tax display issue

* Move calculation functions and settings functions into separate classes

= 3.2.5 (2021-01-28)

* Prevent tax calculation for orders with $0 total

* Add x-api-version header to TaxJar API requests

* WooCommerce 4.9.2 support

= 3.2.4 (2020-12-15)

* Fix occasional missing PTC from subscription orders

* Fix issues that prevented exempt customers from syncing to TaxJar

* WooCommerce 4.8.0 and WordPress 5.6 support

= 3.2.3 (2020-09-28)

* Add filter to nexus check

* Decouple tax calculation and transaction sync settings

= 3.2.2 (2020-09-02)

* Fix international store address validation

* Fix synchronized renewal non applicable message

= 3.2.1 (2020-07-09)

* Fix for undefined settings issue

* Fix for wrong shipping rates

* Increment supported WooCommerce version to 4.3.0

* Increase minimum WooCommerce version to 3.2.0

= 3.2.0 (2020-05-28)

* Add support for tax calculation on orders created through WooCommerce REST API V2 & V3

* Include plugin parameter for requests to TaxJar API

* Increment supported WooCommerce version to 4.1.1

= 3.1.1 (2020-05-15)

* Update WordPress listing content

* Fix bad link in connect TaxJar notification

* Fix TaxJar product exemption codes being altered before sending to TaxJar

= 3.1.0 (2020-04-10)

* Update to settings page using SmartCalcs Connect

* Update User Agent header for requests to TaxJar

* Prevent unnecessary logging when tax calculation not required

* Fix orders created through the WooCommerce API with a fee not syncing

* Confirm compatibility with WooCommerce 4.0.1 and WordPress 5.4.0

= 3.0.15 (2020-03-11)

* Ensure referer and user permissions are validated for ajax methods

* Confirm compatibility with WooCommerce 4.0

= 3.0.14 (2020-01-29)

* Ensure no extra actions are scheduled and clean up unnecessary actions

= 3.0.13 (2020-01-28)

* Update queue processing to fully support Action Scheduler 3.0

* Alter queue processing to handle scheduled actions that fail or timeout

= 3.0.12 (2020-01-06)

* Update supported WooCommerce version to 3.9.0

* Add filter to disable date validation on transaction sync

= 3.0.11 (2019-11-25)

* Fix Action Scheduler load order

* Update WooCommerce supported version to 3.8.0

= 3.0.10 (2019-10-04)

* Fix record stuck in awaiting status in sync queue

* Display last sync error in sync queue

* Clear regions not in nexus from rate table when nexus is updated

* Improve error messaging in logs

* Set synced date on orders when sync is manually triggered

* Display batch ID in sync queue table

* Handle unexpected exemptions during sync

= 3.0.9 (2019-09-18)

* Update validation to support new TaxJar product categories

* Fix missing filter on refund reference IDs

= 3.0.8 (2019-09-06)

* Fix deregister functionality to sent correct store URL

* Remove deregister upon API key update

= 3.0.7 (2019-08-29)

* Fix record sync when product does not exist

= 3.0.6 (2019-08-28)

* Add filter to enabled altering of customer data before sync

* Fix naming of filter to determine if customer should sync

= 3.0.5 (2019-08-21)

* Fix installation issue on multi sites

= 3.0.4 (2019-08-20)

* Fix issue where order can sync without having previously been completed in certain circumstances

= 3.0.3 (2019-08-20)

* Added transaction sync order push to TaxJar

* Added customer sync to TaxJar

* Full support for product exemptions

* Full support for customer exemptions

* Full support for partial refunds

* Full support for fees in tax reporting in TaxJar

* Fix issue syncing refunds with zero quantity line items

* Fix refunds created while order processing not syncing when order completed

* Fix local pickup expected tax reports mismatch in TaxJar

* Fix expected tax mismatch when order contains gift card in TaxJar reports

* Add fallback to billing address when shipping address is empty on sync

* Add filters to allow altering currency and country validation before syncing

* Add filters to allow altering of request data before syncing orders and refunds

* Add hooks to allow setting of order level exemptions during tax calculation and order syncing

= 2.3.1 (2019-08-12)

* Tested up to WooCommerce 3.7

* Tested up to WordPress 5.2.2

* Fix rate lookup when state field contains a space

* Added filters for line items during rate calculations

= 2.3.0 (2019-05-16)

* Added full support for WooCommerce Subscriptions

* Fix performance issue with recalculating shipping

= 2.2.0 (2019-04-25)

* Tested up to WooCommerce 3.6.2

* Fix exemption not applying to large quantity exempt line items

* Add zip code validation before sending SmartCalcs API request

= 2.1.0 (2019-04-04)

* Tested up to WooCommerce 3.5

* Compatibility support for WooCommerce Smart Coupons

* Add filters / actions for custom overrides of plugin functionality

* Check to make sure enabled setting exists after installing the plugin

* Fix empty nexus list issue

* Fix exempt products getting taxed on backend

* Fix taxable to fully exempt shipping in same order

* Fix VAT exempt tax removal in Woo < 3.2

* Fix JSON parsing error for backend orders with variable product variations containing special characters

2.0.1 (2018-08-23)

- Fix local pickup calculations with street address support

2.0.0 (2018-08-16)

- Street address support with rooftop accuracy

- Display native rate tables for custom rates

- Call

woocommerce_after_calculate_totalsafter recalculation for other plugins - Fix backend order calculations in WC 2.6

1.7.1 (2018-07-19)

- Tested up to WooCommerce 3.4

- Skip API requests when there are no line items or shipping charges

- Fix backend order tax calculations for deleted products

- Fix calculations for multiple line items with exemption thresholds

- Fix compatibility issues with PHP 5.2 and 5.3

- Fix tax code precedence for “None” tax status and custom tax class products

- Fix error handling when syncing nexus regions with an expired API token

1.7.0 (2018-05-10)

- Improve performance by skipping calculations in the mini-cart

- Drop TLC transients library in favor of native WP Transients API

- Fix caching issues with tax calculations

1.6.1 (2018-04-05)

- Fix error for WooCommerce stores running on PHP 5.4

- Update “Configure TaxJar” button to point directly to TaxJar integration section

1.6.0 (2018-03-22)

- Tested up to WooCommerce 3.3

- Refactored plugin to better handle total calculations and WC Subscriptions

- Fix nexus overage API issue with expired TaxJar accounts

- Fix rounding issue with line items in WC 3.2

- Add filter hook to TaxJar store settings for developers

- Skip backend calculations for deleted products

- Remove default customer address setting override

- Exempt line items with “Zero rate” tax class applied

- Support UK / GB and EL / GR ISO 3166-1 code exceptions

- Sanitize tax class to handle “Zero Rate” string from Disability VAT Exemption plugin

- Drop WP_DEBUG logging in favor of taxjar.log

1.5.4 (2017-12-08)

- Fix sign-up fees and total issues with WC Subscriptions

- Fix tax for duplicate line items with WC Product Add-ons & WC Product Bundles

- Fix minor logging issue on shared hosts

1.5.3 (2017-11-17)

- Fix total calculations for origin and modified-origin based states

1.5.2 (2017-11-14)

- Recalculate totals in WooCommerce 3.2 instead of updating grand total

- Update “tested up to” for WordPress 4.8.2

- Update integration title

1.5.1 (2017-10-22)

- Fix totals calculation issue with WooCommerce 3.2

- Fix plugin action links filter issue with conflicting plugins

1.5.0 (2017-10-10)

- WooCommerce 3.2 compatibility

- Improve tax rate override notice under WooCommerce > Settings > Tax

- Improve plugin intro copy for support under “TaxJar Integration”

- Fix “limit usage to X items” discounts in WooCommerce 3.1

- Fix

get_idmethod error for discounts in WooCommerce 2.6 - Fix product tax class parsing for multi-word categories such as “Food & Groceries”

1.4.0 (2017-08-17)

- Support backend order calculations for both WooCommerce 2.6.x and 3.x

- Fix backend rate display for orders with multiple tax classes

1.3.3 (2017-08-01)

- Fix initial calculation for recurring subscriptions with a trial period

1.3.2 (2017-07-20)

- Fix local pickup error for WooCommerce < 2.6.2

1.3.1 (2017-06-18)

- Include tlc_transient hotfix

1.3.0 (2017-06-16)

- Product taxability support for exemptions such as clothing.

- Line item taxability with support for recurring subscriptions.

- Fully exempt non-taxable items when tax status is set to “None”.

- Fix calculations to use shipping origin when local pickup selected.

- Fix caching issues with API requests.

1.2.4 (2016-10-19)

- Add fallbacks to still calculate sales tax if nexus list is not populated.

1.2.3 (2016-09-21)

- Limit API calls for tax calculations to nexus areas.

1.2.2 (2016-08-29)

- Fix issue where uncached shipping tax was not displayed

1.2.1 (2016-06-27)

- Fix bug causing sales tax to not be calculated when shipping is disabled

- Pass home_url rather than site_url when linking to TaxJar

1.2.0 (2016-01-19)

- Changes for WooCommerce 2.5 compatibility around transients

1.1.8 (2015-12-30)

- Shipping tax bugfix

1.1.7 (2015-12-23)

- Bump version, wordpress.org failed to create 1.1.6 zip file

1.1.6 (2015-12-22)

- Change wording for connection

1.1.5 (2015-12-14)

- Display Nexus States/Region list on TaxJar panel

- Allow 1-Click TaxJar connection setup

- Bug fixes around order editing in order admin screens.

1.1.4 (2015-10-30)

- Better warnings about connection errors on plugin panel

1.1.3 (2015-09-09)

- Better support for generating API keys in WooCommerce 2.4+

1.1.2 (2015-07-30)

- Handling Shipping tax more accurately

1.1.1 (2015-07-21)

- Fix transient key bug with city (suggest to clear transients in WooCommerce)

- Label text change

- Improve handling of Shipping taxes

1.1.0 (2015-06-26)

- Code cleanup

- Use new v2 TaxJar API (https://developers.taxjar.com/api/)

- New TaxJar graphic

1.0.8 (2015-03-10)

- Bug fixes in the handling of persisted rates

1.0.7 (2014-12-24)

- Fixed

- Fixed a bug encountered when local shipping options were selected for some users

- New

- Adds tax calculation support to WooCommerce for local shipping options

- WooCommerce can now calculate taxes for local pickup shipping option

1.0.6 (2014-11-17)

- Fixed a bug encountered on some hosting providers

1.0.5.2 (2014-11-13)

- Fixed a bug where coupons where being applied on the cart twice

1.0.5.1 (2014-11-06)

- Bug fixes

1.0.5 (2014-09-26)

- Updated

- New way of handling taxes on orders compatible with WooCommerce 2.2

- Uses new API (with support for Canada): read the docs

- New

- Ability to download orders easily into TaxJar

- Shortcuts to access TaxJar Settings

- Freezes settings for WooCommerce Tax (we set everything up for your store’s sales tax needs)

1.0.3 (2014-08-27)

- Fix api url param for woo

1.0.2 (2014-08-26)

- use taxable_address from wooCommerce customer

1.0.1 (2014-08-25)

- TaxJar calc overrides all other taxes

- Hide order admin calculate tax button

1.0 (2014-08-11)

- Initial release